Mobile Payment Gateways for E commerce

Security Considerations for Mobile Payment Gateways

Secure Communication Channels

Mobile payment gateways must prioritize secure communication channels to protect sensitive transaction data. This necessitates the use of robust encryption protocols like TLS/SSL to encrypt all data transmitted between the mobile device, payment processor, and bank. The encryption process should be end-to-end, ensuring that only authorized parties can decipher the transmitted information. Implementing strong authentication mechanisms for each party involved in the transaction is also crucial, safeguarding against unauthorized access and manipulation. This includes methods like multi-factor authentication, which adds an extra layer of security beyond just passwords.

Furthermore, the gateway should utilize protocols that maintain the integrity of the data, ensuring that it hasn't been tampered with during transmission. Regular security audits and penetration testing are essential to identify and mitigate potential vulnerabilities in the communication channels. The implementation of these measures is essential to protecting user data and maintaining the trust of customers.

Data Validation and Sanitization

Thorough data validation and sanitization procedures are critical components of a secure mobile payment gateway. This involves verifying the format, type, and range of data received from the mobile application and ensuring it conforms to predefined specifications. Invalid or unexpected data should be rejected to prevent potential security breaches and malicious code injection. This process helps in preventing common vulnerabilities like SQL injection and cross-site scripting (XSS).

Sanitization is equally important, converting potentially harmful characters or code into harmless forms. This crucial step minimizes the risk of malware or malicious scripts being executed on the payment processor's or bank's systems. Rigorous validation and sanitization are indispensable for maintaining the integrity of the payment process and safeguarding user data.

User Authentication and Authorization

Robust user authentication and authorization mechanisms are essential for mobile payment gateways. These mechanisms should verify the identity of the user and ensure that only authorized users can access and perform transactions. Multi-factor authentication, incorporating methods like one-time passwords or biometric verification, strengthens the security posture considerably.

Furthermore, authorization controls should ensure that users can only perform actions permitted by their roles and privileges. Implementing role-based access control (RBAC) ensures that users can only access the features and functionalities relevant to their specific needs, reducing the potential for unauthorized access and preventing potential data breaches. Implementing these measures is vital for maintaining customer trust and preventing fraudulent activities.

Transaction Logging and Auditing

Comprehensive transaction logging and auditing are vital for detecting and responding to potential security incidents. Detailed logs should record every transaction, including user information, transaction amount, time, and location. These logs provide valuable insights into transaction patterns and can be used to identify unusual activities or potential fraudulent behavior.

Regular auditing of these logs, along with well-defined policies for log retention, enables swift identification and response to any security threats. This proactive approach allows for the rapid detection of anomalies and helps in the investigation of any security incidents that may arise. The data retained by the logs ensures accountability and compliance with regulatory requirements.

Payment Gateway Security Architecture

A secure payment gateway architecture must be designed with security as a primary concern. This includes separating sensitive data handling from non-sensitive operations and employing different levels of access control for different personnel. Employing a layered security approach that incorporates various security controls at different points in the transaction process enhances the overall robustness of the system.

The architecture should also be designed with scalability in mind to accommodate increasing transaction volumes and user bases without compromising security. Regular security assessments of the architecture are necessary to identify and address potential vulnerabilities. A robust payment gateway architecture is foundational to a secure and reliable payment platform.

PCI DSS Compliance

Adherence to Payment Card Industry Data Security Standard (PCI DSS) compliance is crucial for mobile payment gateways. PCI DSS outlines stringent security requirements that ensure the secure handling and protection of payment card information. Meeting these requirements is essential to protect user data and comply with industry regulations. This involves implementing secure network configurations, restricting access to sensitive data, and performing regular security assessments.

Failure to comply with PCI DSS can result in significant penalties and reputational damage for the organization. Implementing and maintaining PCI DSS compliance demonstrates a commitment to data security and customer trust. This commitment is crucial for long-term success in the mobile payment industry.

Mobile Payment Gateway Integration and Scalability

Mobile Payment Gateway Integration

Integrating a mobile payment gateway into your e-commerce platform is a crucial step towards providing seamless and secure payment processing for your customers. This integration process typically involves several key steps, including selecting the appropriate payment gateway that aligns with your business needs, configuring the gateway's API to communicate with your e-commerce platform, and testing the integration thoroughly to ensure smooth transactions. Properly integrating a mobile payment gateway is essential to build customer trust and confidence in your online store, minimizing friction during checkout and maximizing conversions.

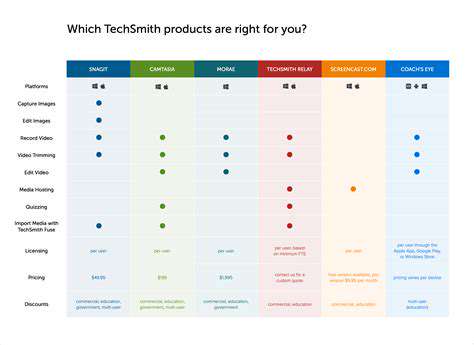

Choosing the right payment gateway is paramount. Factors to consider include transaction fees, payment methods supported, security protocols, and customer support options. A gateway that supports multiple payment methods (credit cards, debit cards, mobile wallets) will increase customer satisfaction by offering flexibility. Furthermore, robust security measures are critical to protect sensitive customer data, ensuring compliance with industry standards like PCI DSS. A comprehensive understanding of the integration process and the various options available is vital for a successful deployment.

Scalability Considerations for Mobile Payment Gateways

As your e-commerce business grows, the ability to scale your mobile payment gateway is essential. A poorly designed or insufficiently scaled gateway can lead to bottlenecks during peak transaction periods, impacting customer experience and potentially harming your business's reputation. Scalability involves the ability to handle increased transaction volumes without compromising processing speed or security. This often requires choosing a gateway provider with robust infrastructure and the capacity to handle fluctuations in demand.

Key considerations for scalability include the gateway's processing capacity, its ability to handle high volumes of concurrent transactions, and its infrastructure resilience. Look for providers with proven experience in handling high-growth businesses and consider the potential need for future upgrades or expansions. A scalable payment gateway is not just about handling current traffic; it's about preparing for and adapting to future growth, ensuring that your payment processing system can keep pace with your business's expansion.

Moreover, consider the gateway's ability to adapt to new technologies and payment methods. The e-commerce landscape is constantly evolving, and a scalable gateway should be able to integrate with emerging payment technologies to maintain a competitive edge and accommodate future customer preferences.

A well-structured payment gateway infrastructure is critical for long-term success. Implementing appropriate security measures and monitoring systems to detect and prevent potential issues are crucial for maintaining a high level of security, especially as transaction volumes increase. These measures are essential for building trust with customers and protecting sensitive data.

Finally, thorough testing throughout the scaling process is essential. Regularly testing the gateway's performance under varying load conditions allows for proactive identification and resolution of potential issues before they impact your customers during peak periods.

Read more about Mobile Payment Gateways for E commerce

Hot Recommendations

- Personalizing Email Content with User Behavior

- Geofencing for Event Attendance Tracking

- Reputation Management on Social Media

- UGC Beyond Photos: Videos, Testimonials, and More

- The Future of Data Privacy Regulations

- Accelerated Mobile Pages (AMP) Benefits and Implementation

- The Future of CRM: AI and Voice Integration

- Google Ads Smart Bidding Strategies: Maximize Value

- Common A/B Testing Pitfalls to Avoid

- Local SEO Strategies for Small Businesses